About the research

New research is showing that the wealth of younger generations is now falling behind the wealth of their predecessors at a similar age. Rising house prices and an uncertain job market have impacted the wealth levels of the different generations, making receiving inheritances much more important for the current young generations than it was for older generations. However, there are concerns about inequality, as inheritances are very unequally distributed, and social mobility, since the growing size and importance of inheritances will benefit the children of wealthier parents (IFS, 2016).

The report ‘Inheritances and Inequality across and within generations’ by the Institute for Fiscal Studies (IFS) and funded by the ESRC-funded Centre for the Microeconomic Analysis of Public Policy (grant number ES/M010147/1) analyses inheritance distribution and its potential impact on inequality across generations.

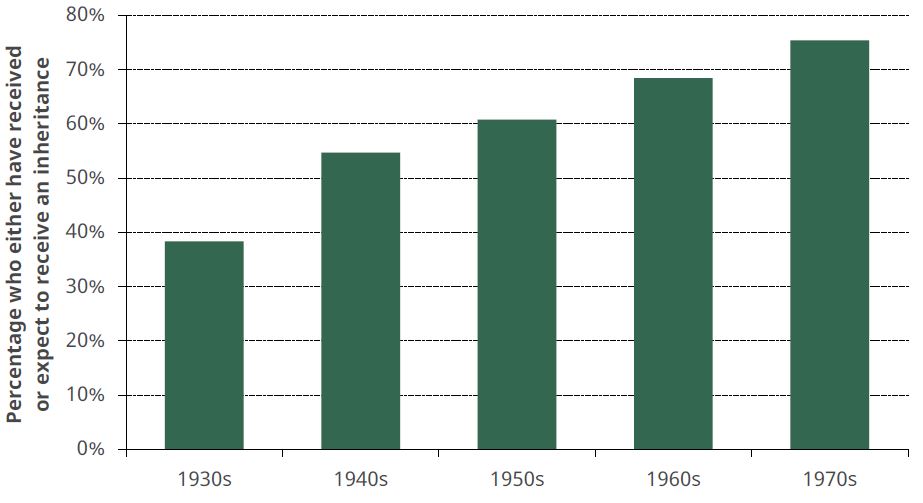

The analysis shows that elderly households now have much more wealth than households of the same age a decade ago and an increased proportion of them intend to leave a large inheritance. In 2012–13, 44% of elderly households expected to leave an inheritance of £150,000 or more, compared with just 24% in 2002–03. Younger generations are therefore much more likely to expect to receive an inheritance than their predecessors. As shown in Figure 1 below, of those born in the 1970s, 75% either have received or expect to receive an inheritance, compared with 68% of those born in the 1960s, 61% of those born in the 1950s, 55% of those born in the 1940s and less than 40% of those born in the 1930s.

Figure 1: Percentage of individuals who either have received or expect to receive an inheritance, for those born in different decades (Source: IFS, 2016)

Findings also reveal that the wealth of elderly households is extremely unequally distributed. The top half of households where all members are 80 or older hold 90% of the wealth, and the top 10% hold 40% of the wealth. Hence a ‘lucky half’ of younger households look likely to get the vast majority of the inherited wealth from the older generation. Moreover, in younger generations, those with higher current incomes are significantly more likely to have received an inheritance or expect to receive one at some point in future.

The report highlights that overall inheritances have become more important for both low- and high- income households. In fact, the poorest fifth of those born in the 1970s are more likely to have received or expect to receive an inheritance than the highest-income fifth of those born in the 1930s.

Methodology

The report analyses the potential impact inheritances can have on inequality within generations of people who are currently of working age. First, it examines the patterns of actual inheritance receipt among pensioners, using detailed survey data on older individuals linked to their lifetime earnings histories from administrative National Insurance records. Second, it combines information on the distribution of current wealth among elderly households and how younger generations’ expectations of receiving inheritances relate to their income, to investigate how the inheritances younger generations receive in future will affect inequality among that group.

The report used two datasets available from the UK Data Service: the Wealth and Assets Survey and the English Longitudinal Study of Ageing (ELSA). These datasets are used to analyse the wealth holdings of elderly households, their intention to leave that wealth to future generations, and younger generations’ expectations of receiving inheritances, to document the growing importance of inheritances.

Findings for policy

The IFS’s report suggests that today’s elderly have much more wealth to pass on than their predecessors, primarily as the result of rising homeownership rates and rising house prices. At the same time, today’s young adults will find it harder to accumulate wealth of their own than previous generations did, due to the sharp fall in homeownership, the dramatic decline of defined benefit pensions in the private sector and the stagnation in household incomes. Together, these trends mean inherited wealth is likely to play a more important role in determining the lifetime economic resources of younger generations, with important implications for inequality and social mobility.

Read the report:

Institute for Fiscal Studies (2017) ‘Inheritances and Inequality across and within Generations’, IFS Briefing Note BN192. Available from: https://www.ifs.org.uk/uploads/publications/bns/bn192.pdf

The report has received extensive media coverage:

Brian Milligan (5 January 2017) ‘Young to inherit more but in less equal amounts, says IFS’, BBC News. Available at http://www.bbc.co.uk/news/business-38517867

Owen Bennett (5 January 2017) ‘Young People’s Wealth More Reliant On Inheritance Than Ever Before, Claims New Study’, The Huffington Post. Available at http://www.huffingtonpost.co.uk/entry/inheritance-tax-wealth-young_uk_586d4859e4b0d590e4504e67

Lianna Brinded (7 January 2017) ‘Here’s why millennials need to inherit rather than earn their wealth’, Business Insider UK. Available at http://uk.businessinsider.com/ifs-inheritances-and-inequality-report-house-prices-cost-of-living-debt-2017-1